Smart futures

BASH has an educational program called Smartfutures.org that hundreds of schools in Pennsylvania require students to complete. Smart Futures asks students a series of questions about their interests and helps them find career paths that fit their interests.

Smart futures also has a multitude of lessons on how to save money, use credit cards, pay off credit cards, learn what interest is, and so many more vital financial necessities that can help to prepare students for the rest of their lives.

Like anything else though, there are still some gaps. The following will have more information on how highschoolers can be financially ready before they graduate.

Information about what student loans are

College can be very pricy. Most students/families cannot afford to pay for a college semester without taking out a loan. According to Studentaid.gov Student loans in 2025 typically have an interest rate of 6.3% for undergraduate Direct Subsidized and Unsubsidized Loans, 8.08% for graduate/professional Direct Unsubsidized loans, and 9.08% for Direct PLUS loans.

When preparing to go to a college, most students will take out a loan. In 2025, roughly 50% of bachelor degree students have ended up taking out a loan of some kind. On average, these students will also be left with roughly $30,000 of debt.

Loans can be very helpful, however, if not handled properly, they can leave you with more debt than the actual price was before the loan. So this begs the question: How can you lessen student debt?

Ways to lessen student debt

With any kind of loan, there will always be a little bit of debt as long as interest exists. While there will always be that burden of debt when getting a student loan, there are ways to relieve that burden and make it a little easier on the person in debt.

One of the easiest ways to manage student debt is through scholarships. Some great websites that provide hundreds of scholarships for not just seniors, but anyone in high school are Scholarships.com, scholarships360.org, and Mycollegeguide.org.

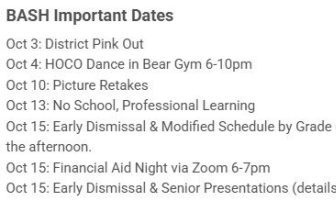

Another great way to lessen student debt is through financial aid. Financial aid will usually provide you with loans to help students financially while also helping to lessen some of the debt at the same time. Click here to see if you may be eligible for financial aid.

Credit cards

Thirty-eight students at BASH were polled and results showed that on average, 53.8% said that they had no idea how to pay off a credit card despite using one. Forty-six point two percent of students said that they didn’t know/weren’t aware of the importance of a credit score. A lot of those students had also written in the survey that they didn’t know anything about credit cards at all and would like to know more.

Credit cards are becoming more and more important as technology advances. When getting a credit card, you need to check your credit score first. To start accumulating a credit score, most people either open a credit card first. Some people will start their own account, or become a user on a parents account. becoming a user on a parents account can be better for a persons credit score depending on how families handle their financials. Your credit score can tell a company whether or not they can trust you to pay off your credit card and be accountable for your purchases. You can easily check your credit score for free at websites like Credit Karma, Experian, Transunion, or Anualcredditreport.com. Credit scores are incredibly important not only to open a credit card, but also to make larger purchases such a buying a car or a house where people are usually required to have a credit score of 620 or above.

As for applying for credit cards, people can apply for one online or in person. When applying in person, people should ask their bank advisers about the process and what the best course of action is for them. If applying online, websites such as BankofAmerica.com are great ways to get more information about how to get a credit card and what the online application process may be.

While owning a credit card, people should also know how to pay it off. Credit cards, similar to loans, are another way to borrow money. The faster it’s paid off, the less debt there’ll be.

To pay off a credit card, people should talk to their bank and ask how they can go about it. Credit cards have their own terms and policies based on different purchase amounts. If not aware of those terms and policies, people can always ask their credit card company and ask about different offers they have.

There is way more financial information out there. Students are highly encouraged to speak to their parents or guardians about what is going to be best for them and their future. Students are also encouraged to talk to counselors, especially for student loans. Counselors will be able to help students with scholarships as well as financial aid information.